In 2019, we set out to give banking a makeover, building the kind of bank that we hoped to see: one that was relevant and ready to help customers meet the demands of the modern world.

Today we celebrate our third anniversary with those same values. We are woman-founded and entrepreneur-led, with an exceptional group of diverse people that work hard every day to change the face and pace of banking. In the last three years, we have been in hyper-growth mode with so much to celebrate already in Piermont Bank’s history.

Here’s a quick summary of what we have accomplished so far:

- Growth: since we opened our doors in July 2019, we have grown to have more than $420 million in total assets as of Q2 2022.

- Innovation: we built an end-to-end digital platform that allows us to actualize our vision as the go-to bank for fintechs. Since launching our banking-as-a-service platform, we quickly went from being a new player to being the top bank for fintechs. We have been lucky to serve customers that are quickly gaining traction in their respective marketplaces.

- Products: in addition to the full suite of commercial banking products, we launched several table stakes banking products for the BaaS platform, including cash management via FBO accounts, ACH, wires, debit cards, and check issuance.

- Communities: since the bank opened, more than 50% of our loans are made to low- and moderate-income communities as well as women and minority owned businesses.

- Media: we have been featured in some of the top digital publications for our contributions to the fintech, technology, and banking communities.

Piermont is built for speed and is client centric

We are building a bank that is relevant for the next generation of entrepreneurs. These past years have presented an unprecedented shift away from brick-and-motor banking to the digital banking experience that Piermont provides. We are guided by our purpose and focus, adapting to the changes around us with speed.

For our fintech clients, we continue to execute on a product roadmap that solves the challenges of the modern marketplace. Our roadmap is always a reflection of what our customers need: better and faster end-user experiences. Since we launched our BaaS platform, we have onboarded more than 40 fintech clients. Some of these fintechs have gone live on our BaaS platform in as little as 4 weeks.

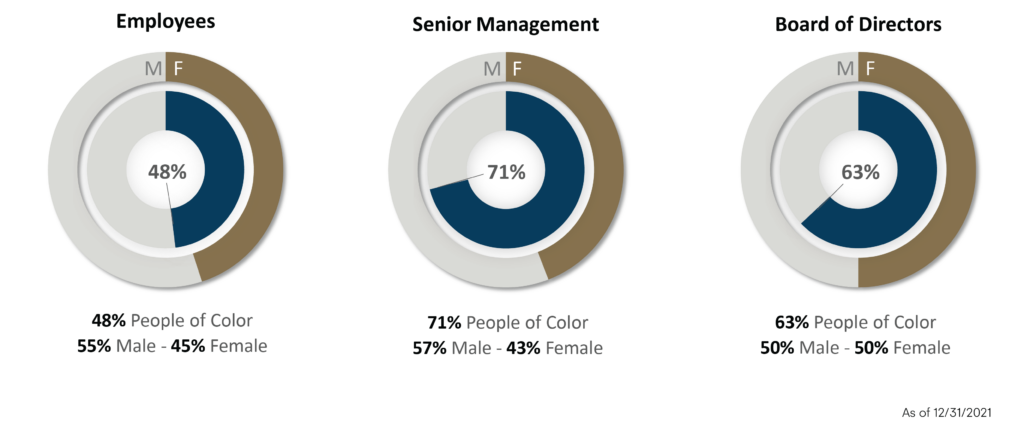

Diversity, inclusion, and changing the face of banking

At the end of the day, the basis of Piermont’s success is and will always be our people. The diversity of our employees, management, and the Board has been one driving differentiator in Piermont. This anniversary, we reflect on how far we have come with the knowledge that this diversity is what makes Piermont what it is today.

We celebrate these past years fostering a team that can serve our customers and communities, build the technology, make strategic decisions, manage the risks, and drive innovation.

We remain steadfast in our vision to build a modern banking experience for the digital age. We are so grateful to our customers and partners for their business and trust these past three years. We look forward to taking Piermont to the next level!