For FinTech

Innovators

Bridging FinTech and Traditional Banking

When we built Piermont in 2019, we set out to change the face and pace of banking, bridging the best of FinTech with traditional banking. For Fintech innovators, that means a bank that works alongside you. A bank that’s committed to delivering fast flexible products and partnering with you to offer creative solutions.

The Right Banking Partner

We believe FinTech companies are a key part of today’s banking ecosystem and co-innovate with them to redefine banking.

We partner with start-ups and scale-ups to develop emerging technology solutions and offer our banking expertise to enable innovators in launching new product and service propositions.

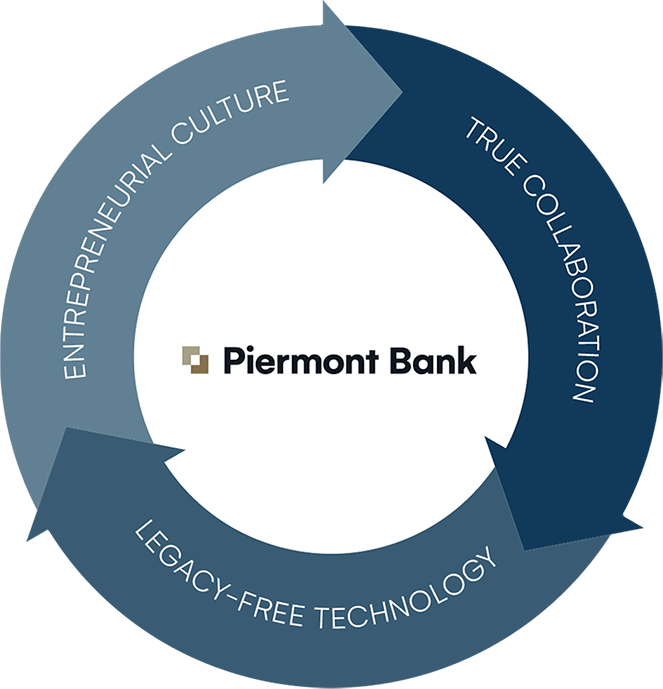

Entrepreneurial culture

we share the same entrepreneurial spirit as you and understand your need for agility and efficient decision-making.Legacy-free Technology

our end-to-end digital platform is unencumbered by tech-debt and able to scale to meet the needs of our FinTech partners.True Collaboration

as a forward-thinking bank, we serve as a sounding board, an advisor, and a compliance resource with robust operational management.FinTech Innovators and Entrepreneurs

You’re introducing the world to new ideas, new ways of doing things, new products. You’re enterprising and creative, yet practical and you’re looking for the same in a bank.

At Piermont, we’ve designed our banking solutions for FinTech companies. We created banking solutions that can pivot alongside you when you are ready to bring your financial innovation(s) to the next level.

Flexible Banking Solutions

For market-ready technology companies looking to enhance or provide banking products to their customer base, Piermont bank offers:

- FDIC-insured depository accounts

- Streamlined payment solutions through APIs

- ACH

- Wire

- Card Issuance

An Alternative to Costly Financing

FinTech companies use our lower-cost financing to fund their lending activities and/ or growth initiatives. Benefit from options that will maximize your equity and drive more efficient revenue generation.

- Working capital for operations

- Warehouse lending to fund a FinTech’s lending portfolio

Compliance and ERM Expertise

We bring decades of banking regulatory and compliance expertise to FinTech companies, to help bridge any compliance gaps and enable faster and seamless growth.

Contact Us

If your company would like to explore a strategic partnership or learn more about our offering, please fill out the form below email [email protected].